Weekly Round-Up: Focus on the US Aviation Industry

As the aviation industry continues to struggle in most countries, the spotlight this week has been particularly trained on the United States. The world's biggest aviation market has receded significantly, and the level of fallout from this reality is only just becoming apparent.

Worker revolt

This is reflected in the news this week that aviation workers across the United States are planning a week of industrial action. One of the more forceful activities, encouraged by the union that represents workers at United Airlines, will see members flooding the White House switchboard, demanding that the authorities extend federal relief.

The financial support is considered essential at a time when thousands of involuntary furloughs and redundancies have been announced by major carriers, such as Delta and United itself. And the action taken by aviation workers will be a part of wider #ReliefNow protests organized across the United States, which will include a march in Washington.

Speaking of United, its ex-CEO and current chairman, Oscar Munoz, predicted this week that US aviation could recede by as much as 50%. Munoz noted that airlines generally in the United States are being forced to cope with inordinately high fixed costs and that this was bound to have an impact on employment.

Munoz told CNN Business that United will “be a smaller airline for some time”. And although he declined to put a precise figure on the number of ultimate redundancies, he was willing to predict that “the numbers are going to be large”. Continuing the theme, Munoz outlined his belief that the “size of the industry is going to be 30, 40 maybe 50% smaller for some time. To some degree, that percentage will be the number of people that will reduce”.

500,000 jobs to go

The figure proffered by Munoz tallies with data reported by Crain's Business this week, regarding the global aviation industry. Crain's expects the global aviation industry to shed a massive 500,000 jobs in 2020.

Crain's pointed out that over 80% of existing job losses have been in Europe and North America, partly due to the quantity of long-haul traffic traditionally associated with these regions. Major aircraft manufacturers Airbus and Boeing have also seen orders plummet, which has had worsened the impact on the industry as a whole.

Most industry observers believe that aviation will take some years to recover, and US airline trade organisation Airlines for America concurred with this verdict as well this week. Airlines for America estimates that the aviation market will not fully recover until 2024, as many experts increasingly believe that the process of recovery will be a lengthy one.

Boeing cuts

In the immediate future, the coming months could be particularly challenging for the industry in the US. Boeing may cease production of the 787 Dreamliner at its Everett, Washington facility, which is hugely significant for the economy, as Boeing aeroplanes are the single most valuable export of the United States.

Boeing currently has two separate assembly lines for its 787 Dreamliner, one in Everett, and one in North Charleston, South Carolina. But the company is currently contemplating a decision, which would see Boeing consolidate those two lines in a single location.

While some involved in the industry feel that the authorities could do more to support aviation, the US government has made a significant effort to buttress the industry. The Federal Aviation Administration recently announced $1.2 billion in airport safety and infrastructure grants. The 434 grants involved will be distributed among 405 airports.

“This $1.2 billion federal investment will improve our nation’s airport infrastructure, enhance safety, and strengthen growth in local communities, which is especially important as the economy recovers from COVID-19,” U.S. Transportation Secretary Elaine L. Chao commented in an official statement. Philadelphia International Airport, Louisville Muhammad Ali International Airport and San Diego International Airport will be among the recipients.

Balance of power

At a time when aviation in the US is floundering, it seems that the impact on the balance of power in the global market will be far-reaching. China has long since been predicted to overtake the United States as the world's largest aviation market, but the Covid-19 pandemic is set to accelerate this. China has targeted aviation with its 'Made in 2025' strategy, and the arrival of the Commercial Aircraft Corporation of China (COMAC) aircraft is also set to revolutionize the market.

As the US continues to negotiate with Britain at a time in which the UK government has been accused of “overseeing the demise of UK aviation”, it seems that the aviation lockdown may have more profound impacts on the industry than were initially envisaged.

READ NEXT...

78524

78524Tracking Helicopters With RadarBox

Today we'll explore how to filter and track helicopters on RadarBox.com. Read this blog post to learn more...- 30334

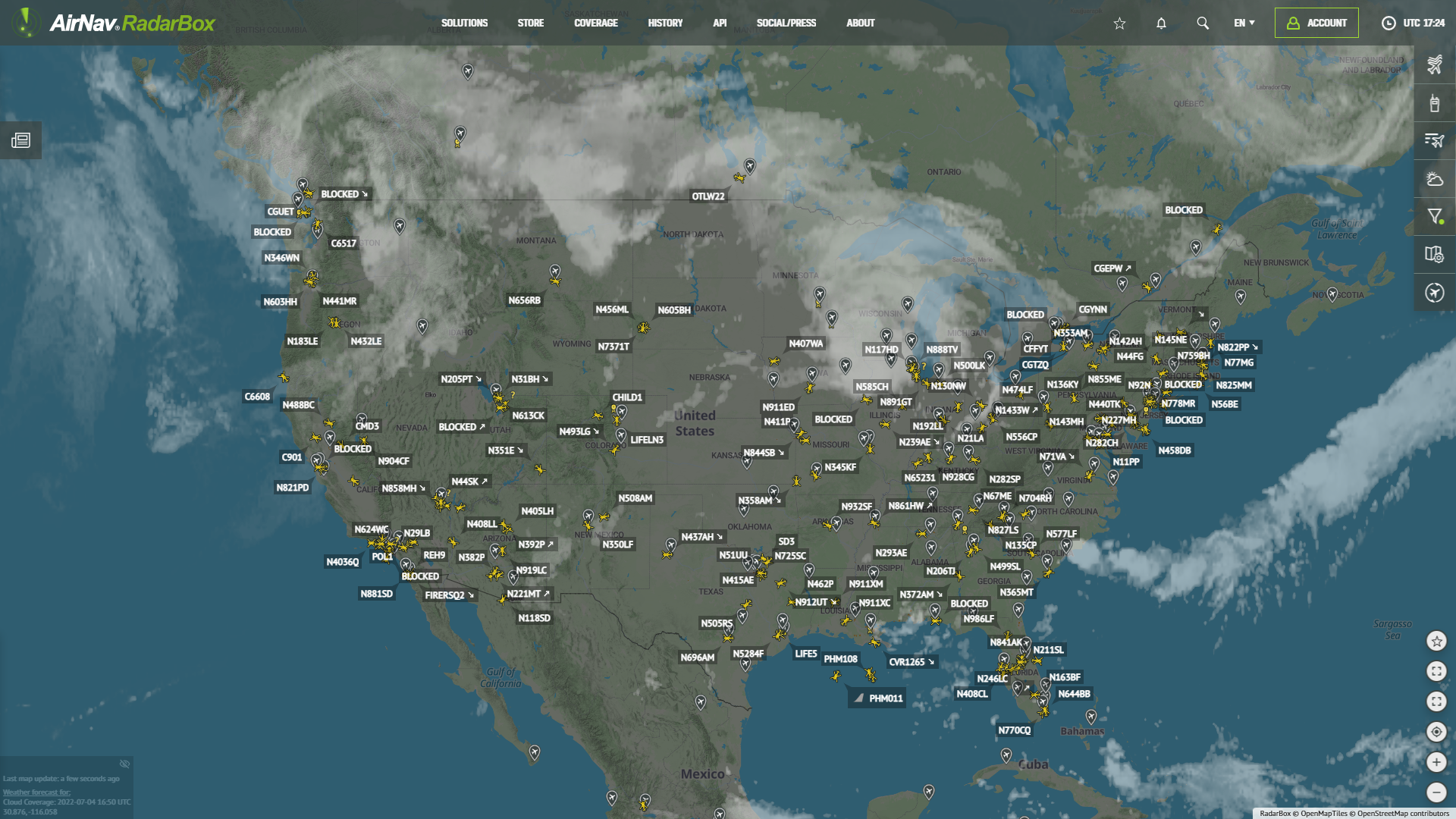

AirNav Announces Coronavirus Related Data & Graphics Available

AirNav Systems is providing data COVID-19 air traffic related data for analysis, study and use.  21771

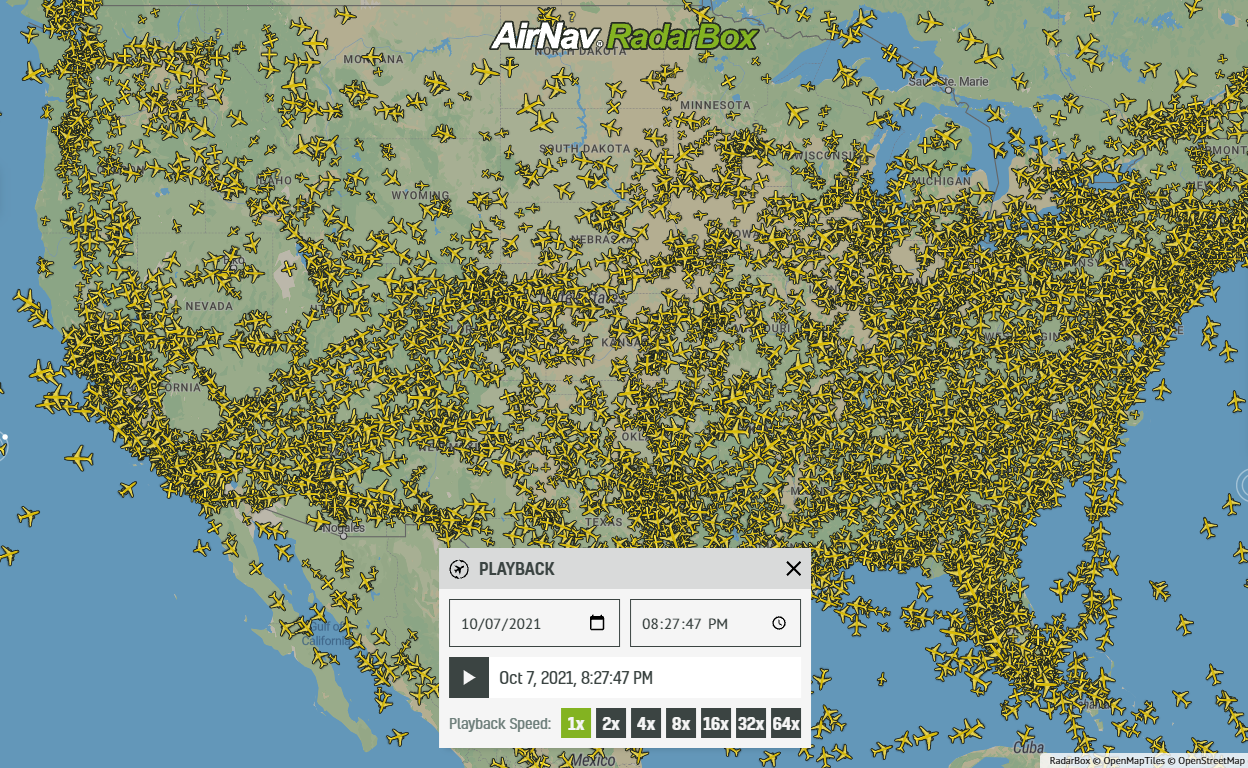

21771Replay Past Flights with Playback

AirNav RadarBox officially launches the playback function on RadarBox.com, allowing users to replay the air traffic for a specific date and time in the past, within a 365-day period. Read our blog post to learn more about this feature.