Weekly Round-Up: Covid Crisis Continues to Dominate Headlines

As July draws to a close, there is little light at the end of the tunnel for the aviation industry, based on current prognosis. This week the International Air Transport Association (IATA) forecast the international air travel won't return to its pre-Covid levels until 2024 – 12 months later than has previously been predicted.

Providing its latest analysis of the coronavirus climate, the IATA pointed to poor coronavirus containment in the United States and developing countries, and what it believes to be commercial challenges related to business travel.

The organisation also revised its 2020 passenger numbers forecast to a 55% decline; sharper than the 46% decrease that the association had forecast just three months ago. “The second half of this year will see a slower recovery than we'd hoped,” IATA Chief Economist Brian Pearce commented.

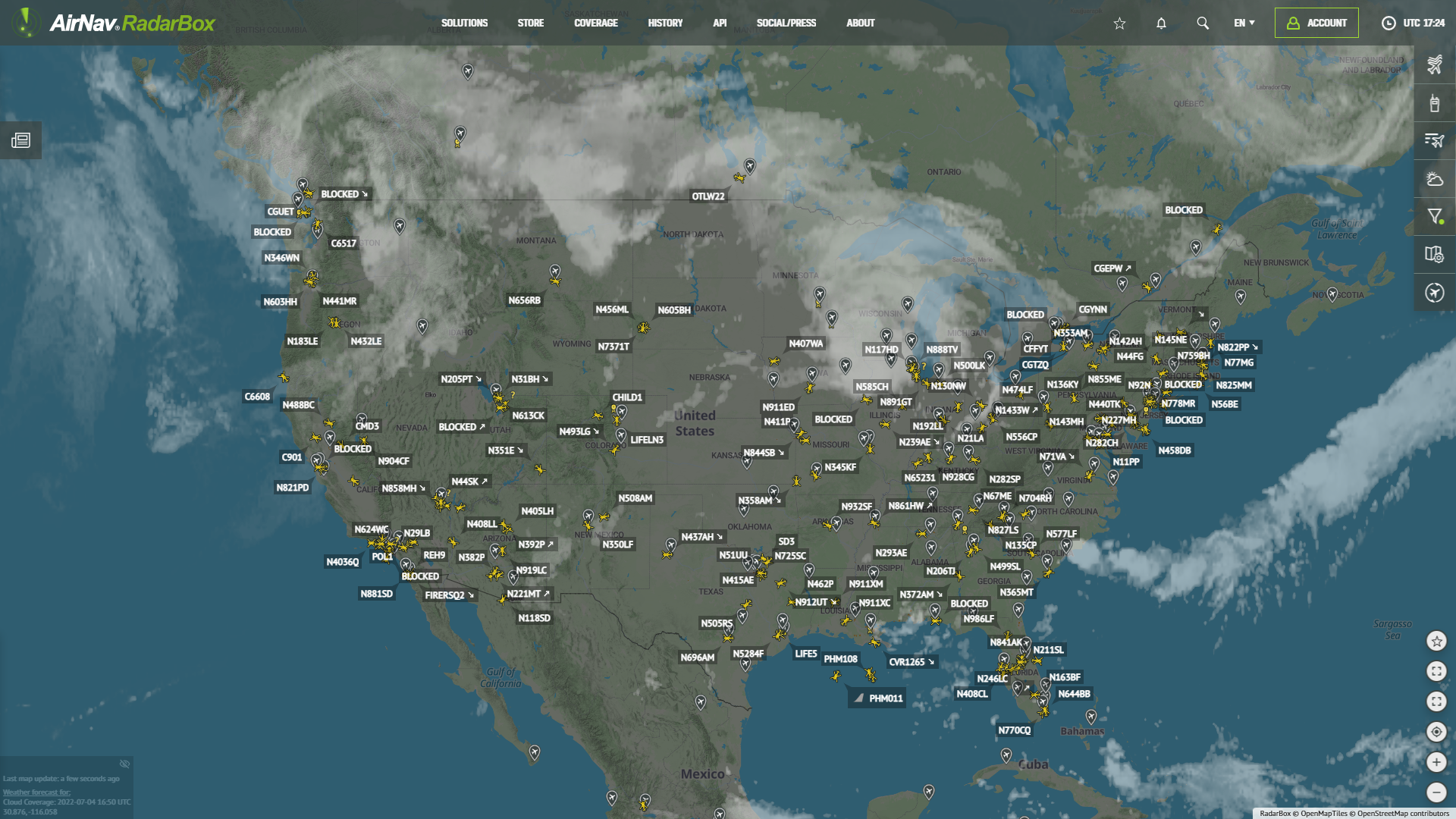

(Above: Radarbox data shows the vast decline in commercial flights)

As the industry continues to jolt at the signs of any uncertainty, the decision of the UK to reenforce quarantine arrivals from Spain has had a negative impact according to Pearce. The analyst is also somewhat sceptical that the business community will immediately return to its pre-Covid level of flying. “It will remain to be seen whether we see a recovery to pre-crisis business travel patterns,” Pearce said. “Our concern is that we won't”.

Boeing prognosis

Iconic airline manufacturer Boeing largely concurs with the verdict of the IATA, also warning this week that the aviation market will take years to recover from the seismic blow that it has absorbed recently. Boeing predicted that demand for flights won't reach pre-Covid levels for another three years, as it posted a $2.4 billion quarterly net loss.

Boeing delivered just 20 commercial jets in the second quarter of 2020, as compared with the 90 that it delivered during Q2 last year. Chief executive David Calhoun indicated in a comment to investors that Boeing's business couldn't be expected to return to normal until at least 2023.

India breaking point

The Centre for Asia Pacific Aviation (CAPA) similarly warns that the aviation industry in India has reached “breaking point”. The comments come as IndiGo, the largest airline in India, posted a net loss equivalent to $4480 million for Q2.

“The record quarterly loss of $380 million posted by IndiGo in 1QFY2021 is consistent with CAPA India's earlier projection of a consolidated industry loss of $1.50-1.75 billion. With Q2 largely a washout due to poor demand, the industry is at a breaking point,” CAPA India commented on Twitter.

(Above: Even the Indian domestic market has struggled to recover from the Covid crisis)

The airline analyst also predicted that few airlines in India have the financial might to survive, and that multiple airline collapses would have a devastating effect on connectivity in the world's second most populated nation.

Western issues

Western airlines continue to be heavily hit as well. KLM announced this week that it will cut 5,000 jobs, while United Airlines revealed plans to furlough one-third of its pilots. While United dealt with its staffing issues, Delta announced that it will only operate 30% of its international routes for the foreseeable future, as the Covid crisis continues to bear down weightily on the airline industry.

But some measures are being implemented in an attempt to deal with the enormity of the problem. Lufthansa and Centogene opened a mass COVID-19 testing facility at Frankfurt Airport just four weeks ago, and have managed to process over 40,000 tests during this period.

The center effectively provides a blueprint for how airlines and regulators could deal with the Covid crisis going forward, and the facility has proved hugely popular in Germany. It is also encouraging that only 100 of those tested have tested positive for COVID-19 - a rate of just 0.25%.

However, implementing an effective testing regime across the planet has proven to be logistically complex. The Association of Asia Pacific Airlines Director General Subhas Menon lamented the high costs of testing passengers, and called on governments to assist the airline industry.

“We need advice from public health experts on how to go about that. If it is cheap enough then maybe you can expect travellers to pay for it. At the moment the cost is quite intimidating,” Menon told Reuters.

Healthy strategy

Nonetheless, some airlines have also put together strategies that will stand them in good stead to survive, and even prosper, as the Covid issue drags on. The University of London's Visiting Lecturer in Air Transport Management, Linus Bauer, noted this week that Qatar and Etihad airlines have put together an operational strategy that will enable them to merge healthily from the challenging climate that is currently prevalent.

“Flying semi-empty A380 around the world is not economically profitable at all. Qatar Airways and Etihad Airways, on the other hand, have a heterogeneous fleet of 100-seater (A319) to 500-seater (A380), and medium-sized, efficient jets such as the A350 or Boeing 787 with less than 350 seats; these can be used more flexibly across the entire route network of both airlines,” Bauer commented.

As the Covid crisis continues to unfold, Radarbox will keep you in touch with all of the latest and most important information.

READ NEXT...

78361

78361Tracking Helicopters With RadarBox

Today we'll explore how to filter and track helicopters on RadarBox.com. Read this blog post to learn more...- 52091

Air France Boeing 777 and American Airlines Boeing 737 experienced a near miss over Caribbean

Air France Boeing 777-300 and American Airlines Boeing 737-800 experienced a near miss over the Caribbean Sea. The planes were safely separated after the TCAS got activated. - 30329

AirNav Announces Coronavirus Related Data & Graphics Available

AirNav Systems is providing data COVID-19 air traffic related data for analysis, study and use.