Weekly Round-Up: Rising Covid Cases in Europe Impacts Aviation

As Covid-19 cases show signs of rising once again in Europe, the airline industry has inevitably been impacted. One of the immediate casualties has been 20% of Ryanair flights, with the budget carrier choosing to trim its portfolio quite considerably. “Forward bookings have notably weakened over the last 10 days,” the airline commented in a statement.

Ryanair had been intending to operate at 70% of normal capacity; a figure that many industry observers deemed overly optimistic. Rival Easyjet had opted for a far more conservative 40%, and this now appears to be a shrewd move, following the Ryanair cancellations.

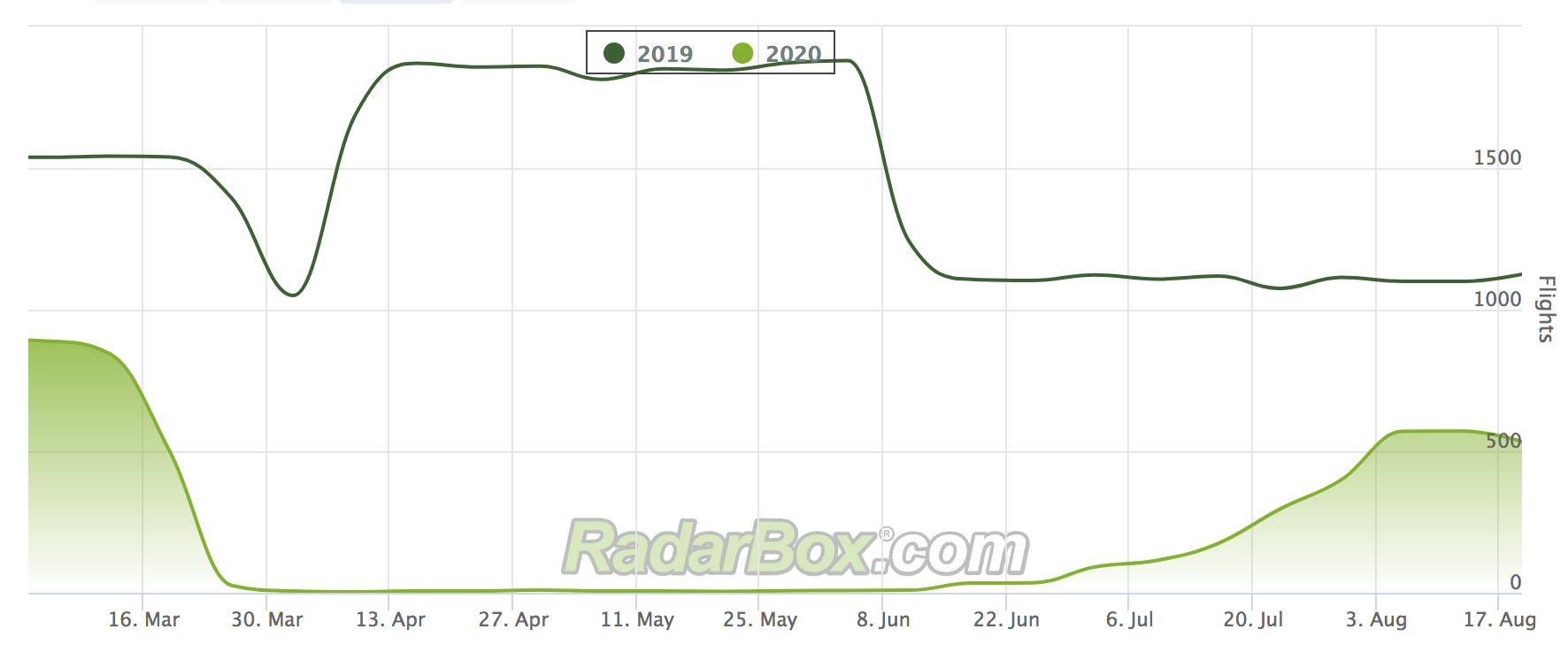

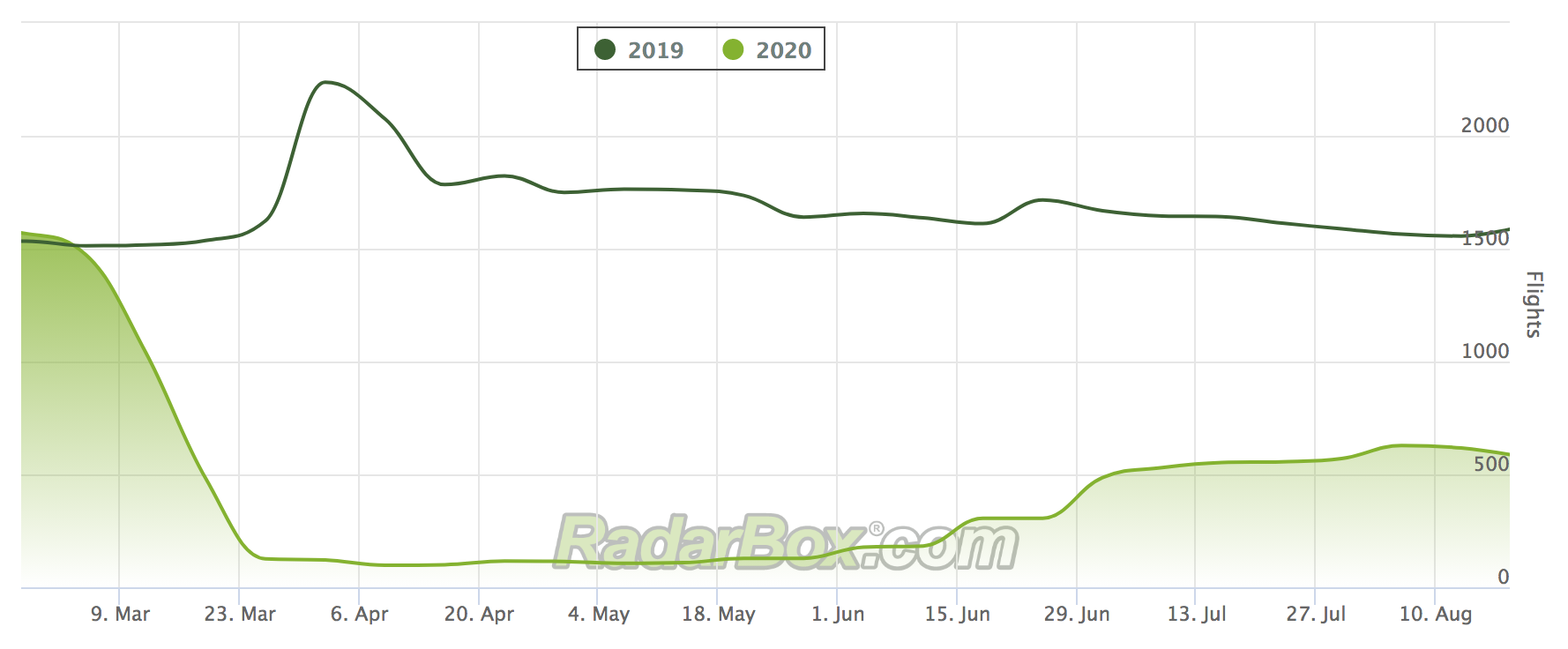

Easyjet has been particularly hard hit by the restrictions imposed by Covid-19, in what was already a difficult climate for the low-cost airline:

(Above: EasyJet flight figures)

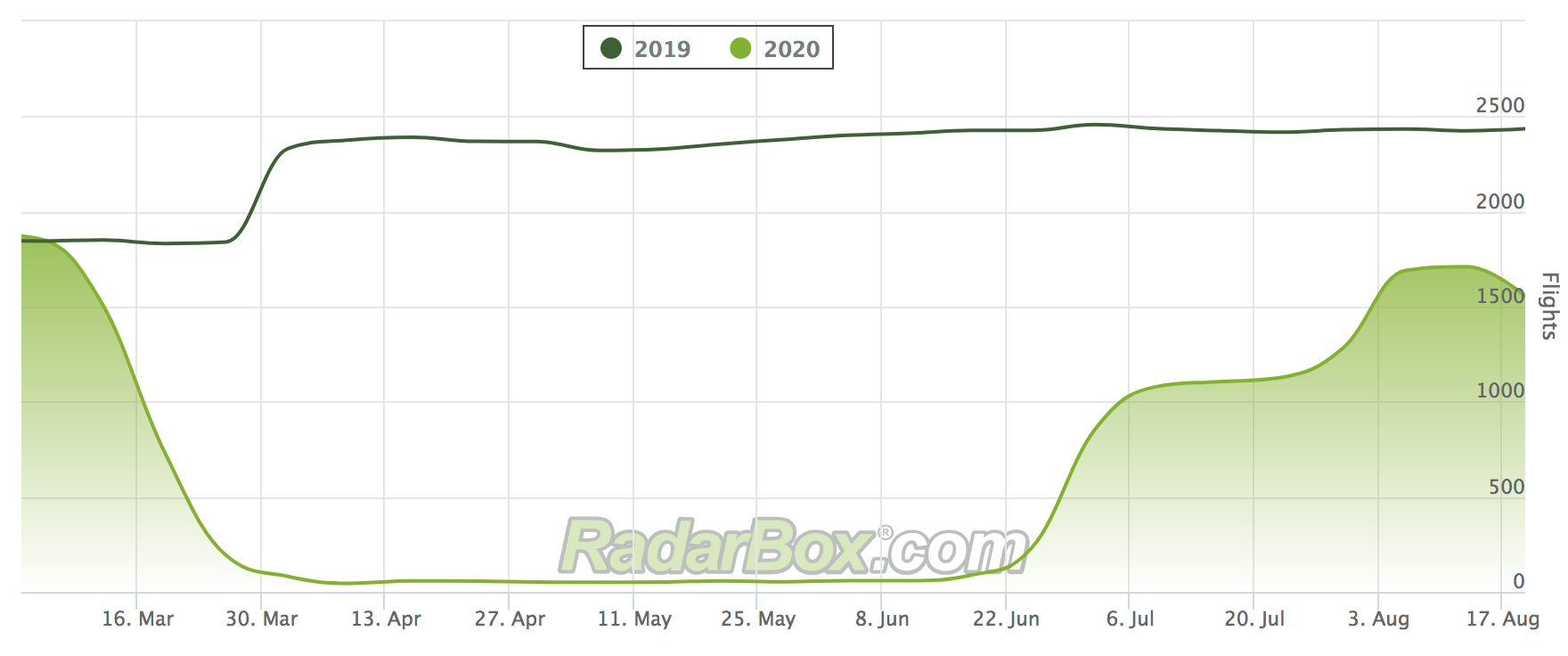

While Ryanair has shown some signs of recovery, but it still lagging well behind its usual capacity:

(Above: Ryanair flight figures)

And hopes that Ryanair had of beginning to ease towards a normal portfolio of flights were dashed by quarantine measures imposed on France, Malta and the Netherlands. Short-haul operators continue to deal with a challenging climate, and this has impacted on UK airports as well.

EasyJet axes flights

This was underlined this week by EasyJet axing a raft of flights from Newcastle International Airport in the UK. The budget airline announced that it will completely close down its north easy base, with similar decisions also being made at London Stansted and Southend. Not only are airports affected, but holidaymakers also face the prospect of losing their bookings.

Newcastle Airport has confirmed that it is in discussions with other airlines, with the intention of providing replacement flights to the impacted destinations.

“Over 80% of the international destinations affected are already served by our existing airline partners and we will continue discussions regarding their interest in the other impacted destinations. For any passengers affected by flight cancellations who wish to rebook with another airline from Newcastle, car park bookings can be amended free of charge,” a spokeswoman for the airport commented.

UK aviation hit

With the International Air Transport Association having reported that UK aviation has suffered more than any other nation, the importance of getting back on track quickly for the nation's carriers is critically important. The airlines’ association calculates it will cost 780,000 British jobs, and cut nearly $60 billion (£46 billion) from the UK’s GDP.

Germany's aviation industry faces similar difficulties, with half of its 1.1 million jobs under threat, according to reports this week. The BDL aviation industry association in the nation suggests that the ongoing restrictions on people's movement has hampered a recovery for Germany's airlines, and the long-term consequences for aviation employment will be profound.

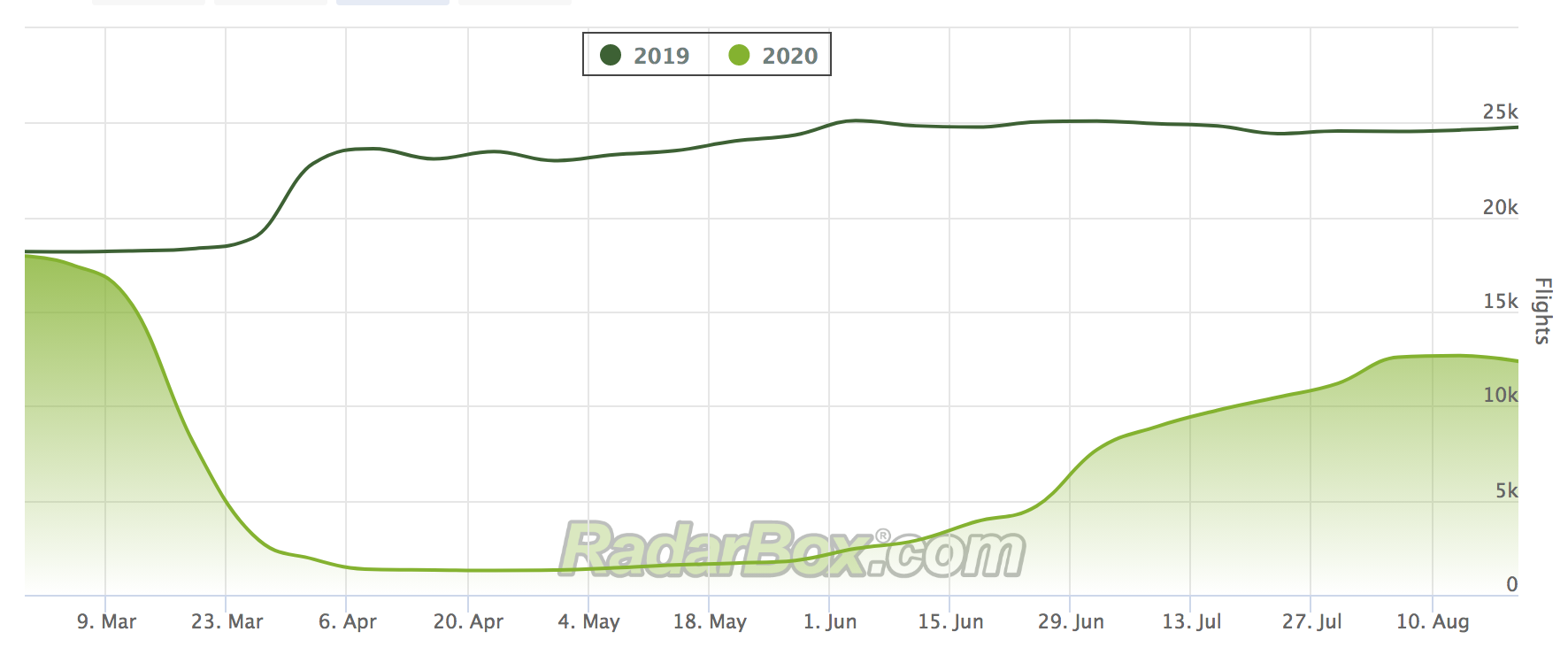

Passenger numbers within Europe have begun to increase, but even began to dip again over the last seven days, after some governments imposed quarantine restrictions following a spike in cases.

(Above: Europe flight figures)

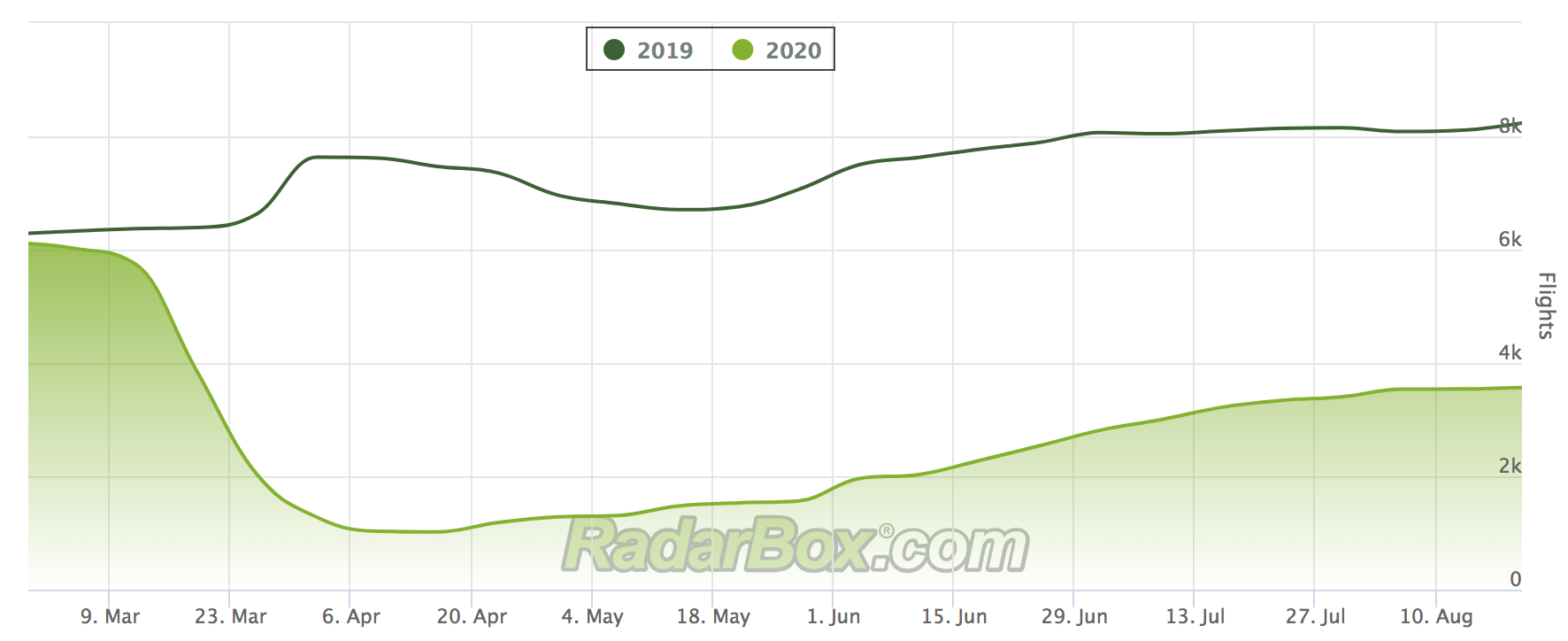

And the international market from continental Europe has been hugely affected by the strict limits that have been placed on intercontinental travel.

(Above: Europe international flight figures)

Impact on cargo in Germany has been less severe, but even the volume transported here has slumped by 15%. Nonetheless, Germany's major cargo airports in Frankfurt, Leipzig and Cologne performed better, have performed reasonably well, with a declined of only 10% collectively.

Lufthansa struggling

But Germany's flagship Lufthansa carrier has already been forced to rely on state bailouts for survival, and the immediate future for the airline industry in Europe's largest economy appears grim, certainly based on union sentiment. Radarbox figures show that Lufthansa has particularly struggled with passenger numbers.

(Above: Lufthansa flight figures)

It is this environment which has led Germany’s main aviation industry group to propose the creation of limited air-travel corridors between major US and European hubs. The proposal would link US airports in Chicago, Boston, Los Angeles and New York City-adjacent Newark, N.J., with Frankfurt and Munich in Germany, along with other major European cities. The aim of the scheme would be to revive the international market in Germany.

Germany’s main aviation industry group has proposed the creation of limited air-travel corridors between major U.S. and European hubs, a bid to crack open the nearly dormant market for trans-Atlantic flight. Covid-19 testing exists at the German airports and could quickly be installed elsewhere, according to the group behind the idea.

United is in close touch with its partner Lufthansa on the German proposal, spokeswoman Leslie Scott commented in a widely circulated email. “As we indicated in the letter to U.S. and European authorities, we support passenger testing as a means of safely re-opening international markets,” Scott stated.

Stocks bounceback

While much of the news coming out of the aviation industry is a little bleak, the potential for a bounceback is never far beneath the surface. UK travel stocks recovered this week, after the UK government confirmed that it would like to scrap the blanket two-week quarantines imposed on returning holidaymakers.

Although the road ahead may be rocky, as restrictions are lifted, and more flights go online, the industry as a whole will begin to awake from its slumber.

READ NEXT...

78062

78062Tracking Helicopters With RadarBox

Today we'll explore how to filter and track helicopters on RadarBox.com. Read this blog post to learn more...- 30311

AirNav Announces Coronavirus Related Data & Graphics Available

AirNav Systems is providing data COVID-19 air traffic related data for analysis, study and use.  21666

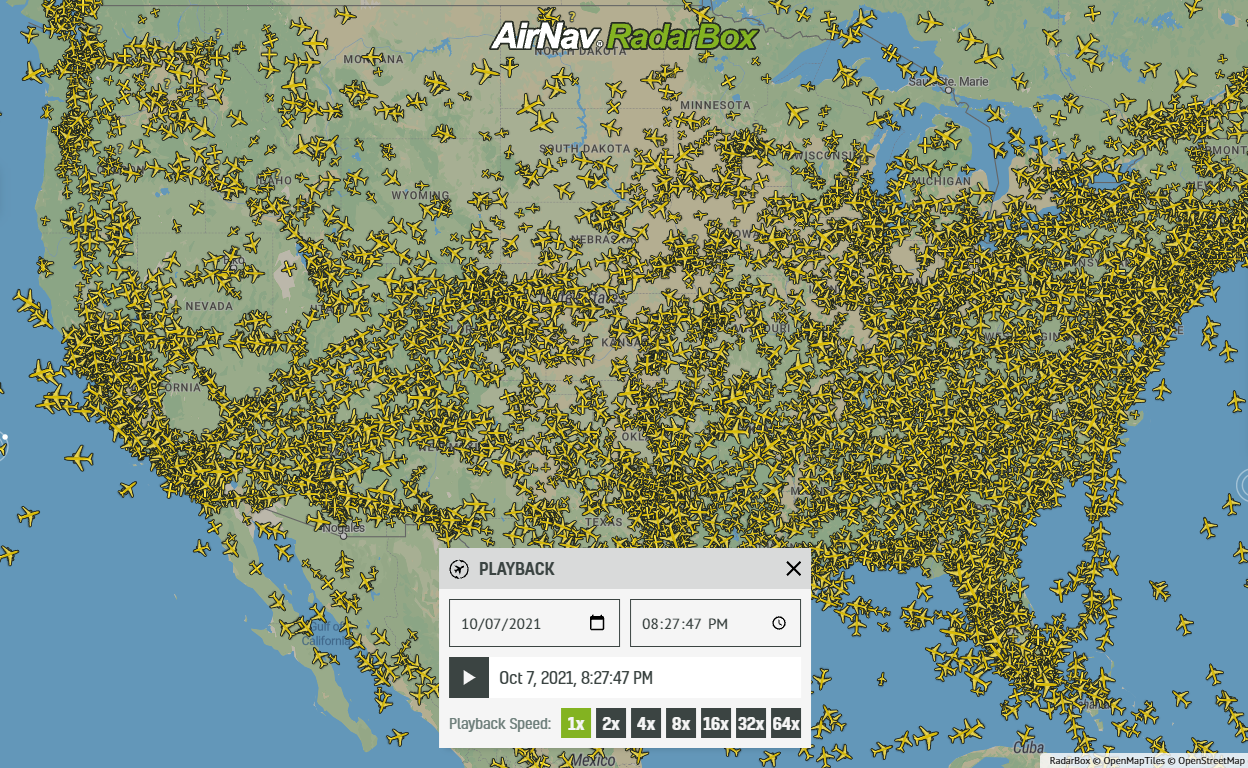

21666Replay Past Flights with Playback

AirNav RadarBox officially launches the playback function on RadarBox.com, allowing users to replay the air traffic for a specific date and time in the past, within a 365-day period. Read our blog post to learn more about this feature.