Weekly Round-Up: British Airways and Airbus Differ on Covid Crisis

At a time when companies across the aviation industry are recalibrating their operations, one name synonymous with aircraft struck a note of optimism this week. Katherine Bennett, senior vice president of Airbus, believes that the medium-term prospects of the aviation industry are actually quite promising, if the psychological barriers to flying can be overcome.

Bennett told the PA news agency that Airbus is already involved in “constructive discussions” with governments about what state support it might receive. And that this, coupled with the general public returning to air travel, could help steer Airbus and other similar businesses back in the right direction.

“We need to get people flying again, we're a long-term industry. The prospects are good if the market restores, which we guess will be in a few years' time. We need to get more aerospace people working in research centres,” Bennett asserted.

With Airbus having reduced production by 40% as a result of the Covid crisis, it is clear that the impact on the business has been significant. Employees and trade union representatives have worked closely with Airbus, but many workers will still reflect gravely on the comments of Bennett.

Airbus has already announced over 1,700 job losses in the UK as a result of the pandemic, while Airbus sites in other countries may also be affected by the fallout. It seems that Airbus, though, is coping with the current climate better than its great rival.

Boeing woe

S&P Global Ratings cut its outlook on U.S. plane manufacturer Boeing this week, trimming its rating to "negative" from "stable". S&P believes that recovery in the aerospace industry could take longer than expected, as the coronavirus continues to take its toll on aviation.

“This could result in weaker cash flow over the next few years, making it difficult for Boeing to pay down debt and improve earnings before interest, taxes, depreciation, and amortization (EBITDA) and restore credit metrics,” S&P Global commented.

The good news for Boeing was that the credit rating agency declined to take any action on the creditworthiness of Boeing, meaning that the aviation giant maintained its BBB- long-term rating. In making this decision, S&P asserted that there remains “sufficient liquidity” at Boeing.

Boeing Chief Financial Officer Greg Smith had largely confirmed this impression when speaking at a virtual conference on Wednesday, when he outlined the fact that Boeing sees no requirement to add liquidity via additional debt offerings at this point in time. Boeing's “priority one” is instead to pay down its debt, and resurrect its balance sheet so that it is in prime position when the industry recovers.

BA forced redundancy

British Airways has also been in the news regularly during the ongoing pandemic, and this week has not been without controversy for the company. The flagship carrier of the United Kingdom has already announced that it wants to axe no less than 12,000 jobs, and it now faces the onerous task of working out how this will proceed.

Making things slightly easier for BA is the fact that 6,000 staff have already volunteered to be made redundant. But that still leaves the airline with another 6,000 roles to cut, while it seems that some of the voluntary redundancies aren't quite as 'voluntary' as British Airways might have suggested.

Voluntary redundancy row

The BBC reported this week that BA has compelled workers to take voluntary redundancy by forcing certain staff to apply for their own jobs, and then compelling them to take statutory redundancy payouts if they were unsuccessful. Clearly this has piqued workers at the luxury airline, leaving unions angry with BA's working practices.

But the airline has defended itself, suggesting that changes being made now are necessary in the long-term outlook for the industry. The chief executive of IAG – the flagship owner of BA - Willie Walsh told the BBC that “anyone who believes that this is just a temporary downturn and therefore can be fixed with temporary measures, I'm afraid seriously misjudges what the industry is going through.”

BA pilots have already accepted a 20% pay cut, which saved 1,250 jobs, but the airline remains in dispute with cabin crew and engineers. The former have been encouraged to accept diminished pay and working conditions. As the aviation industry rests, such disputes could become the new normal.

Flight data

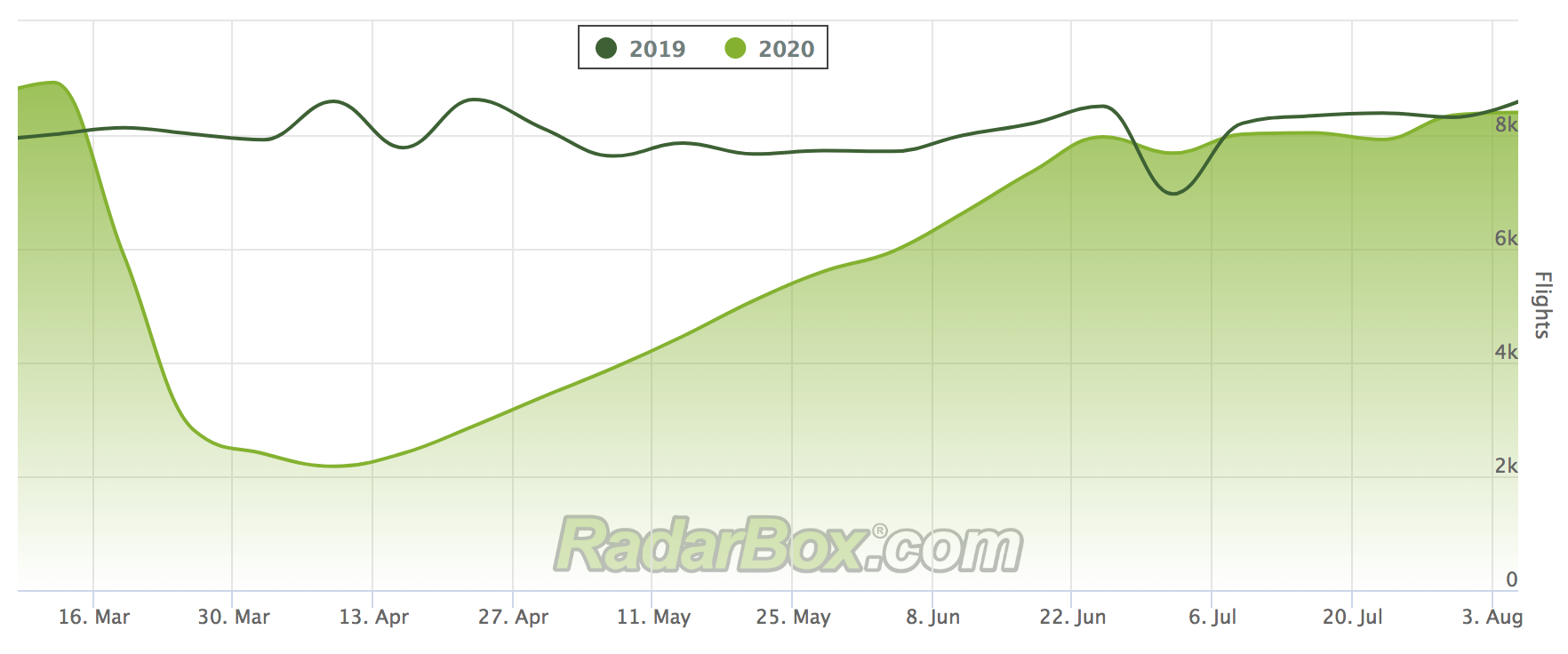

While commercial flights are beginning to edge in the right direction for the industry, there is little sign of a sudden rush of activity. The curve of flight data continued to head upwards in July, but global flights will still down nearly 50% year-on-year.

(Above: Total flights from Match to present)

However, a crumb of comfort for the aviation industry is that business travel has largely returned to pre-Covid levels. In fact, the number of flights in the week from July 2 to July 8 actually slightly exceeded the figures for the same period last year.

(Above: Business flights from March to present

This data indicates that it is commercial flights that need to recover, and that the general public must embrace travel once more, if the industry is to recover. While many industry experts believe this process may take several years to unfold, there does seem to be light at the end of the tunnel for some of the embattled industry players.

READ NEXT...

- 30310

AirNav Announces Coronavirus Related Data & Graphics Available

AirNav Systems is providing data COVID-19 air traffic related data for analysis, study and use.  21657

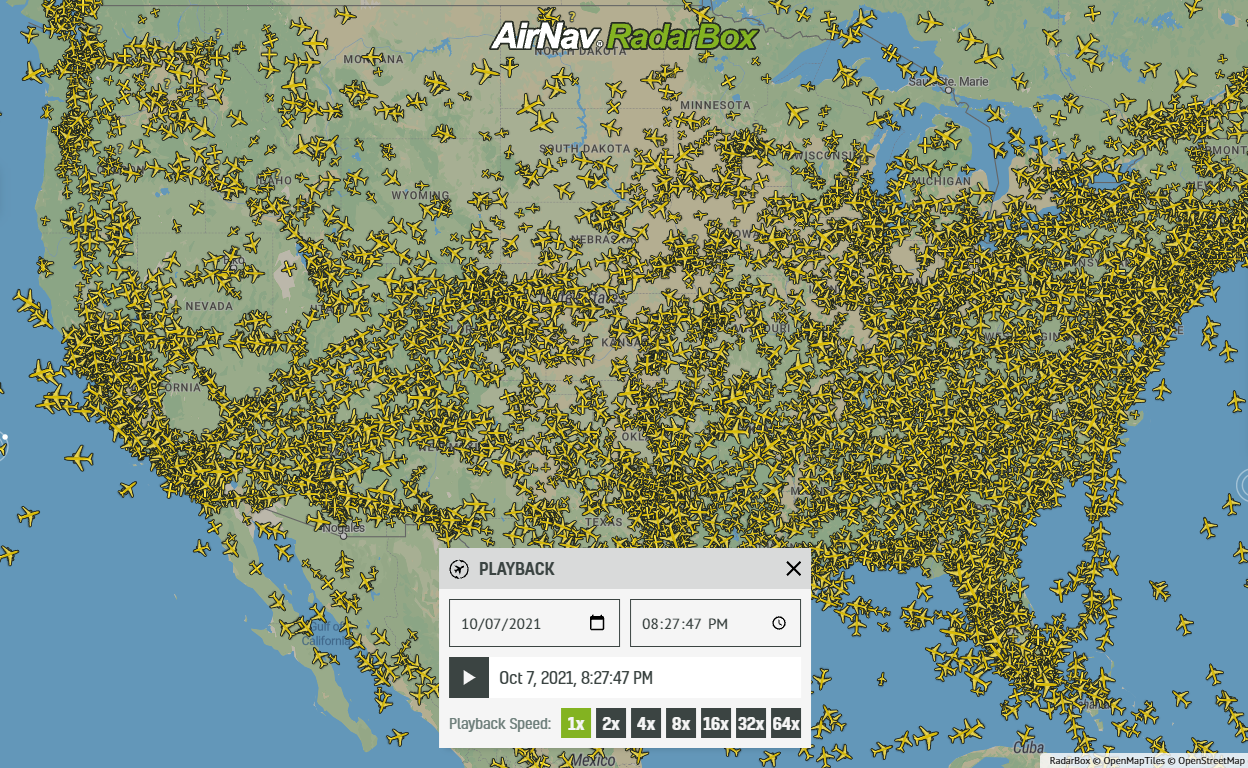

21657Replay Past Flights with Playback

AirNav RadarBox officially launches the playback function on RadarBox.com, allowing users to replay the air traffic for a specific date and time in the past, within a 365-day period. Read our blog post to learn more about this feature. 12842

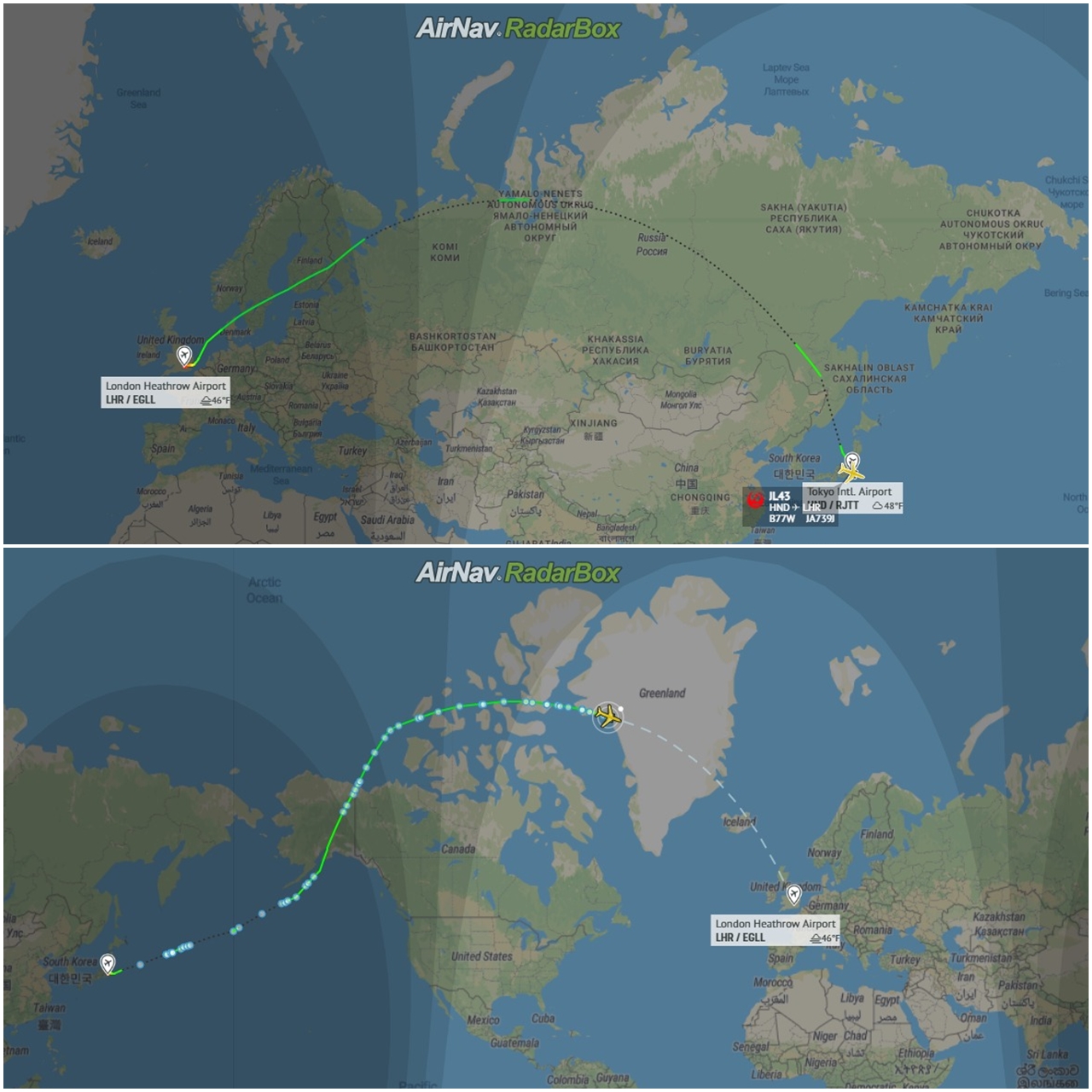

12842Some airlines are flying longer than usual

Following the war in Ukraine and the airspace restrictions due to the Ukraine-Russia conflict, several airlines have been experiencing increased operating costs with detours and consequently longer flights, generating more costs. Read our blog post to find out more!