Trump Imposes Iran Sanctions in Challenging Time for Middle East Aviation

The decision of the Trump administration to impose sanctions on two aviation companies in the United Arab Emirates threatens to have a massive negative impact on the country. And this worrying news comes at a time when flights in the Middle Eastern country were beginning to recover, following the swinging impact of Covid-19.

At the heart of the issue was the assertion of the US administration that the two airlines worked with an Iranian carrier that was already subject to sanctions. As a double-whammy, the US government has also filed criminal charges against one of the companies for violations of US export control regulations.

US sanctions

The sanctions are aimed at UAE-based Parthia Cargo and Delta Parts Supply, along with Amin Mahdavi, the owner of Parthia. The companies will also see assets in US jurisdictions frozen, while foreign companies that typically do business with the two firms may also be affected.

Of particular concern to the Trump administration has been the willingness of the two companies to provide parts and logistics services to Iran’s Mahan Air, which has been subject to sanctions related to counterterrorism since 2019. At that time, the US had condemned the carrier's support for Iran’s Islamic Revolutionary Guard Corps; considered a terrorist organization by the US State Department.

“The Iranian regime uses Mahan Air as a tool to spread its destabilizing agenda around the world, including to the corrupt regimes in Syria and Venezuela, as well as terrorist groups throughout the Middle East. The United States will continue to take action against those supporting this airline,” Treasury Secretary Steven Mnuchin commented in an official statement.

Terrorist support

The US has accused Mahan Air of transporting IRGC-supplied weapons and personnel from Iran, in support of the Lebanon's Hezbollah movement, and the Syrian regime of Bashar Assad. Airports in the UAE have often served as hubs for such flights. The US has had a long-standing concern over Iran, and the two countries have had soured diplomatic relations for several decades.

This news will come as a major blow to the airline industry in Iran, which was beginning to show signs of recovery. The latest data released by the Iran Airports Company indicated that international air traffic in Iran had grown in recent weeks, after Iran was forced to absorb a massive slump in both passenger and cargo sectors.

IAC date shows that all international takeoffs and landings, as well as the handling of passengers and cargo, increased by 100%, 89% and 100% respectively in the four-week period from June 21 to July 21. Nonetheless, this still represented a 45% fall in the number of passengers transported, and a 51% reduction in cargo year-on-year.

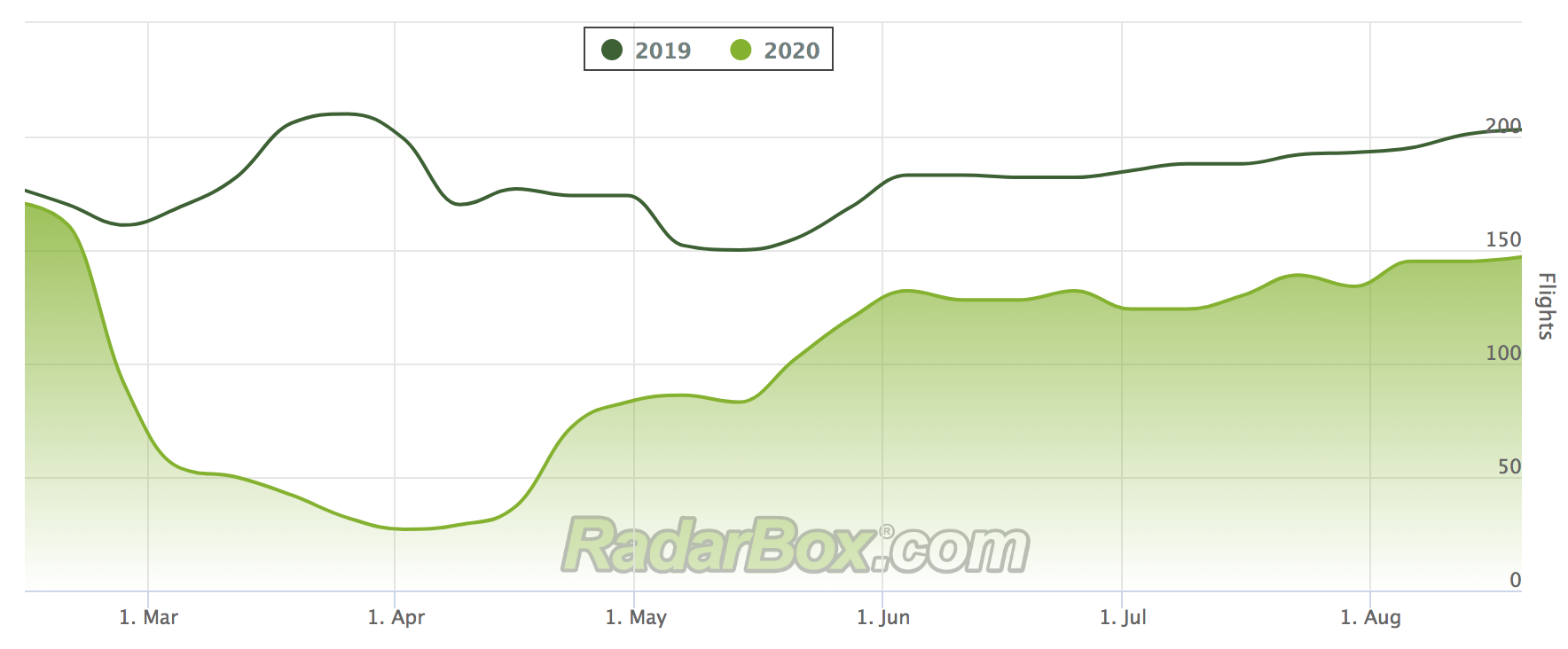

Radarbox data shows that flights in Iran have recovered at a faster pace than in many Western nations. While the country has yet to return to full capacity, the number of domestic flights in the country has returned to nearly two-thirds of normal levels.

(Above: Domestic flight figures for Iran)

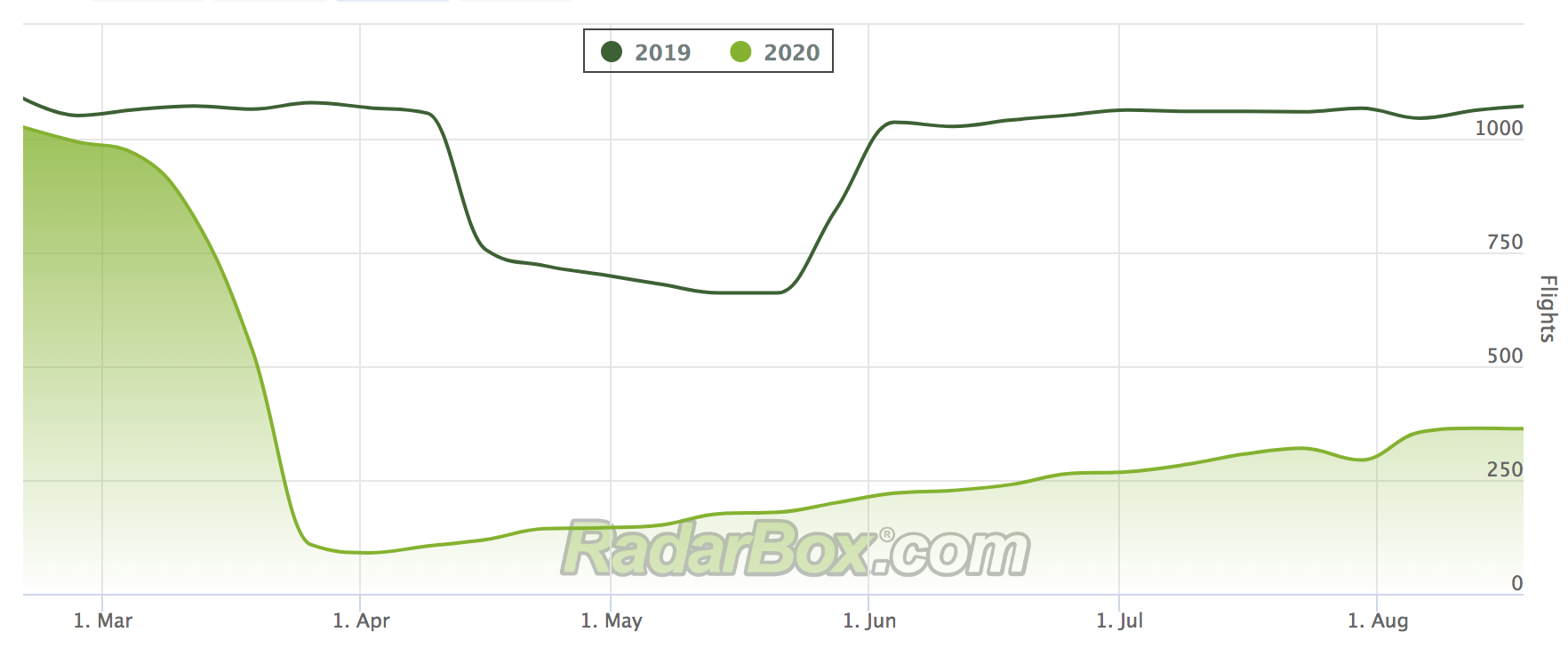

This also applies to international flights, which exceeded 70% of normal capacity during July.

(Above: International fight figures for Iran)

While the UAE has become a prolific nation in the airline industry, it has also been impacted several by Covid. Emirates Airline president Tim Clark recently commented that the recovery of the sector is reliant on a vaccine, and that a sustained policy of social distancing would be an “economic catastrophe”.

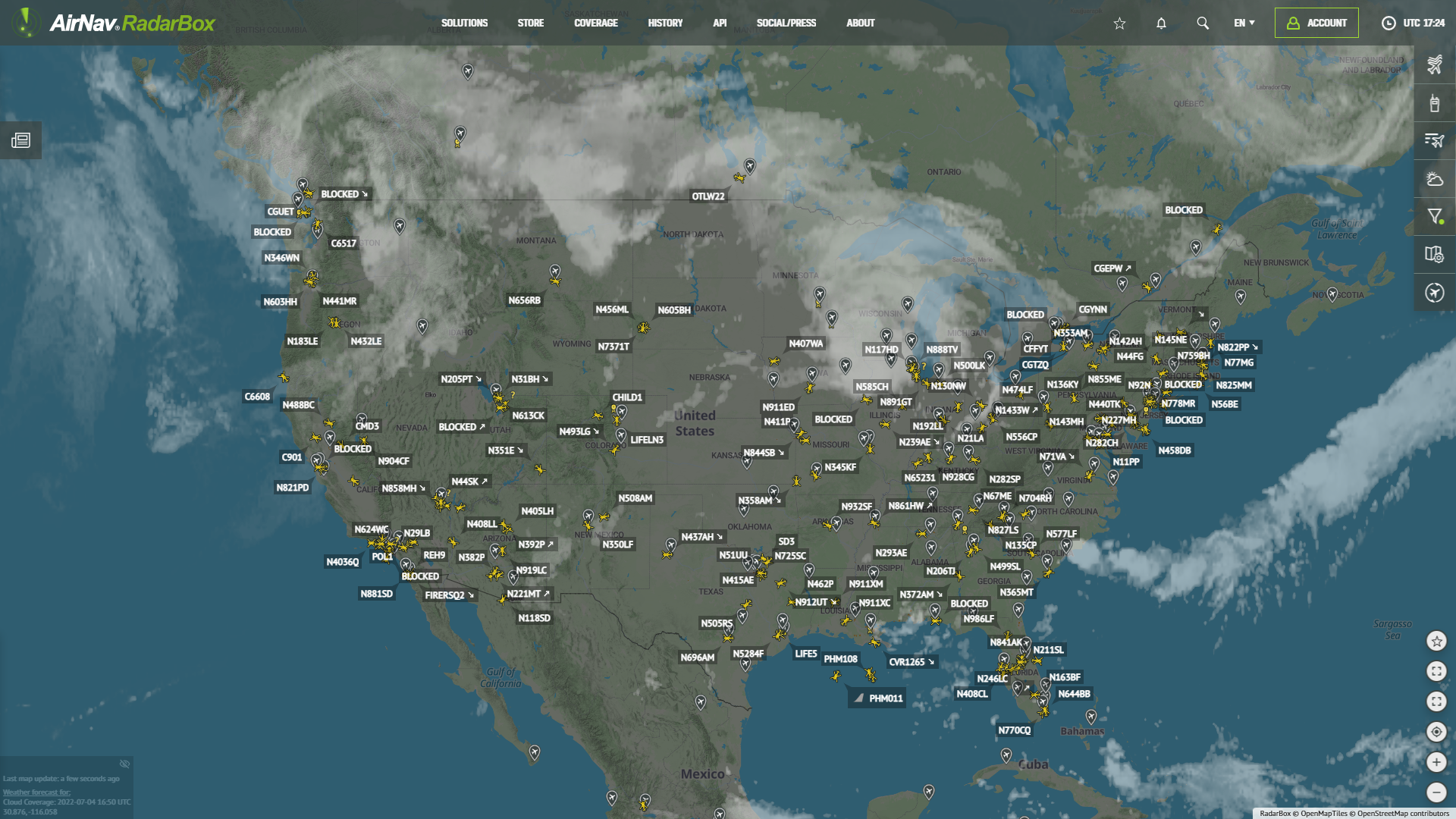

It is easy to appreciate the views of Clark when one views the flight figures for the principle airport in the country – Dubai International.

(Above: Flights figures for Dubai International Airport)

Dubai issues

Dubai International is still operating at little more than 30% capacity, and clearly there is a huge appetite in the country and region for this worrying picture to change rapidly.

With the entire industry feeling the pinch, it was also reported this week that Etihad had refused to write off the $120 million debt of Air Serbia. Emirates is a 49% shareholder in the Serbian national carrier, and has told Air Serbia that its “management board feels that Air Serbia’s proposal to reduce the amount which was set in a loan contract by 82 percent is unacceptable,” according to documents leaked to the Serbian press.

While Air Serbia has claimed that insolvency is not out of the question, it seems that Etihad is unwilling to budge, at a time when the Middle East aviation industry faces untold challenges.

READ NEXT...

77957

77957Tracking Helicopters With RadarBox

Today we'll explore how to filter and track helicopters on RadarBox.com. Read this blog post to learn more...- 52068

Air France Boeing 777 and American Airlines Boeing 737 experienced a near miss over Caribbean

Air France Boeing 777-300 and American Airlines Boeing 737-800 experienced a near miss over the Caribbean Sea. The planes were safely separated after the TCAS got activated. - 30305

AirNav Announces Coronavirus Related Data & Graphics Available

AirNav Systems is providing data COVID-19 air traffic related data for analysis, study and use.